What can I do now to save for retirement?

There are lots of things in life you can't control, but your savings for the future doesn't have to be one of them. At Edward Jones, we partner with you to understand why you're saving and can then help you determine what you can do today to help you get there.

So what can you do today to make a difference down the road? When it comes to saving for retirement, we think there are three main things to think about.

The power of three

- Time – how long you save

- Money – how much you save

- Return – how much your investments earn

You control time and money. And while you may think you have little control over the return, you actually control more than you think. You control the "how," or how you have your money invested. That's because how much you have in cash or fixed income versus growth investments can greatly affect your return potential. Use our investment calculator to see the impact a few changes to your savings plan can make.

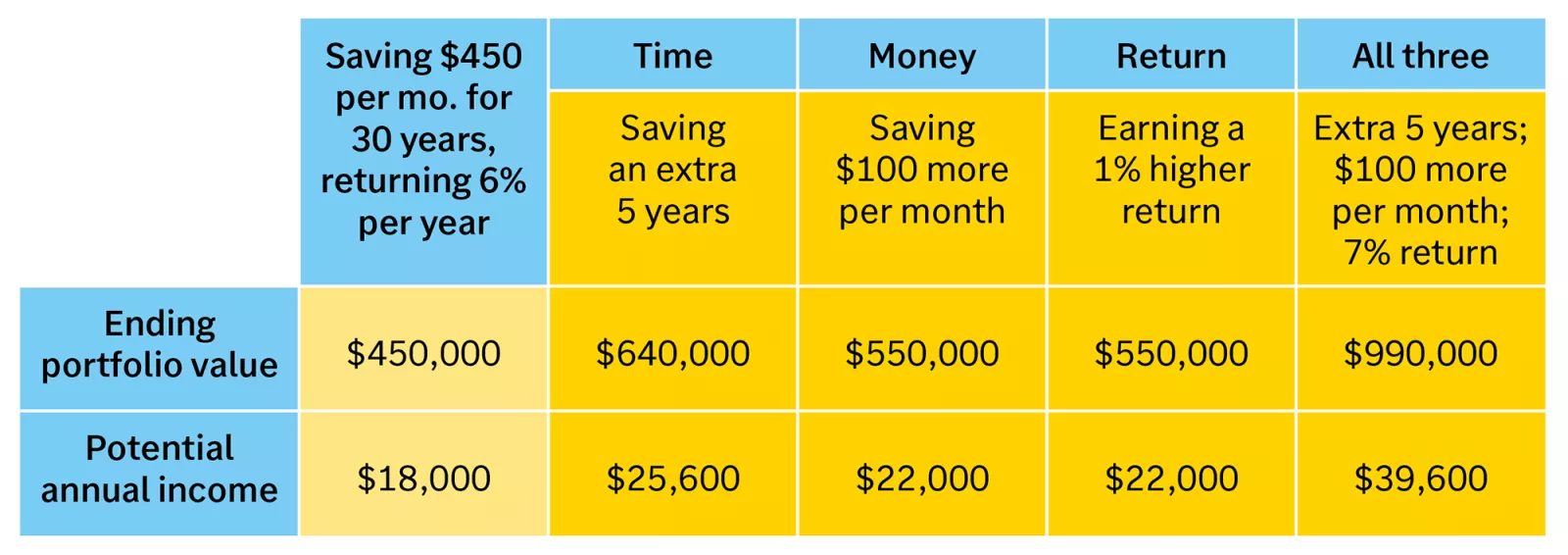

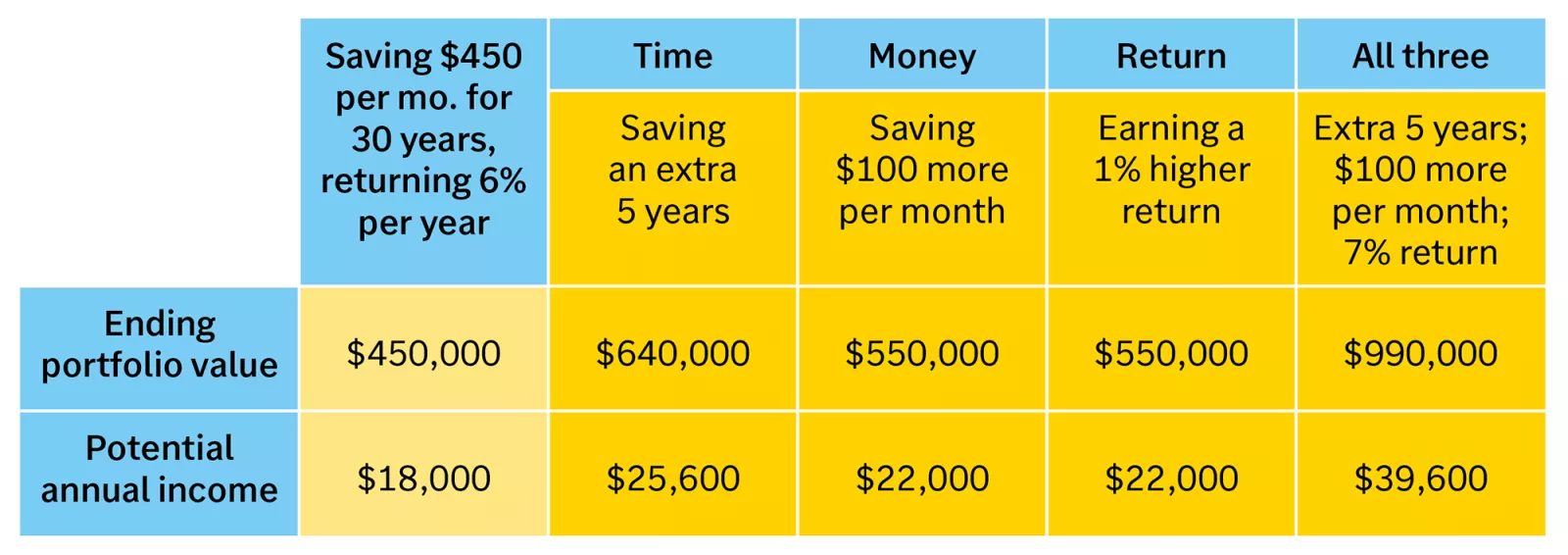

The table below shows how small changes in each (or in all three) of these may help you better meet your goals.

Putting time, money and rate of return to work for you

This chart demonstrates the power of time, money, and return on your retirement savings. If you save $450 per month for 30 years and earn 6% per year, you'll have saved $450,000 which results in potential annual income of $18,000. However, when you save an extra five years, the portfolio value increases to $640,000 and the potential annual income increases to $25,600. When you save an extra $100 each month or earn an additional 1% each year, the portfolio value increases to $550,000 and the potential annual income increases to $22,000. If you do all three - save an extra five years, save an extra $100 each month, and earn an additional 1% each year - the portfolio value increases to $990,000 and the potential annual income increases to $39,600.

This chart demonstrates the power of time, money, and return on your retirement savings. If you save $450 per month for 30 years and earn 6% per year, you'll have saved $450,000 which results in potential annual income of $18,000. However, when you save an extra five years, the portfolio value increases to $640,000 and the potential annual income increases to $25,600. When you save an extra $100 each month or earn an additional 1% each year, the portfolio value increases to $550,000 and the potential annual income increases to $22,000. If you do all three - save an extra five years, save an extra $100 each month, and earn an additional 1% each year - the portfolio value increases to $990,000 and the potential annual income increases to $39,600.

One simple way to incorporate investing into everyday life is through systematic investing. For example, by automatically investing a set amount of money each month into an individual retirement account at Edward Jones, you can help make sure you're putting as much money away as you can. This may help you reach retirement even sooner.

How we can help

If you want to see how some of these changes can impact the big picture and help better position you to reach your goals, just ask your Edward Jones financial advisor. You can review different scenarios together to see what makes the most sense for you. Even small changes, such as saving a bit more, can be beneficial over the long term.